Get the free ibr application form

Show details

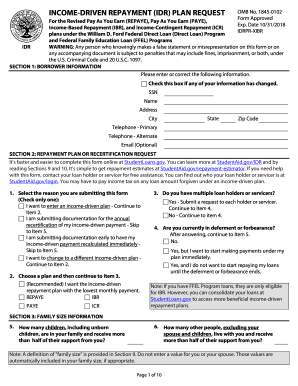

IBR/PAYE/ICR OMB No. 1845-0102 Form Approved Exp. Date 11-30-2015 WARNING Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying document is subject to penalties that may include fines imprisonment or both under the U.S. Criminal Code and 20 U.S.C. 3 If I am delinquent in making payments under my current repayment plan at the time I request one time I enter the repayment plan I requested. Unpaid interest that accrues during this forbearance...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ibr application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ibr application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ibr application form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ibr form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out ibr application form

How to fill out ibr forms:

01

Start by gathering all the necessary information and documents such as your Social Security number, tax returns, and income information.

02

Access the official website of the organization that provides the ibr forms. Download the forms or find an online version that you can fill out electronically.

03

Carefully read and understand the instructions provided with the forms. Make sure you comprehend the eligibility requirements and any specific documentation needed.

04

Begin filling out the forms accurately and truthfully. Provide all the requested information, such as your personal details, income, family size, and previous loan information.

05

Double-check all the information you have entered to ensure accuracy. Mistakes or incomplete information can result in delays or denials.

06

If you have any questions or concerns while filling out the forms, contact the organization's customer support for assistance.

07

Once you have completed filling out the forms, review them one last time to verify the accuracy of the information.

08

If the ibr forms require a signature, make sure to sign and date them as instructed. Failure to do so may invalidate the forms.

09

Submit the completed forms following the provided instructions. You may need to mail them or submit them electronically, depending on the organization's requirements.

10

Keep copies of the completed forms and any supporting documents for your own records.

Who needs ibr forms:

01

Individuals who have federal student loans and may be struggling to make their monthly loan payments.

02

Borrowers who want to apply for income-driven repayment plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), or Revised Pay As You Earn (REPAYE).

03

Those who wish to lower their monthly loan payments based on their income and family size.

04

Borrowers who have experienced a significant change in income or family size and need to update their repayment plan.

05

Individuals seeking loan forgiveness options, such as Public Service Loan Forgiveness (PSLF), which may require completing periodic ibr forms to prove eligibility.

Video instructions and help with filling out and completing ibr application form

Instructions and Help about repayment plan request pdf form

Fill repayment plan request : Try Risk Free

People Also Ask about ibr application form

How do you qualify for IBR repayment?

What is an IBR form?

How do I get an income-driven repayment plan?

What documents are needed for income driven repayment?

What does IBR mean in mortgage?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ibr forms?

IBR Forms are online forms used to submit certain tax documents to the Internal Revenue Service (IRS). IBR forms are used to report income, deductions, credits, and other tax information to the IRS. They can also be used to request an extension of time to file a tax return, request a refund, or make payments.

Who is required to file ibr forms?

The Internal Revenue Service (IRS) requires all taxpayers to file Form IBR, Individual Business Return, if their business income exceeds certain thresholds. This form is required for both sole proprietorships and partnerships.

What is the purpose of ibr forms?

IBR forms are used to apply for an income-driven repayment plan for federal student loan borrowers. This plan allows borrowers to make payments based on their income and family size, which can help borrowers manage their student loan debt more effectively.

What information must be reported on ibr forms?

The information required to be reported on an IBR form includes the borrower's name, address, Social Security number, date of birth, student loan information, and repayment plan. Additionally, the form will require the borrower to provide income information, family size, and other necessary information to calculate the borrower's monthly payment amount.

When is the deadline to file ibr forms in 2023?

The deadline to file IBR forms for the 2023-2024 academic year has not yet been announced by the Department of Education. Please check the Federal Student Aid website for updates on the filing deadline.

What is the penalty for the late filing of ibr forms?

The penalty for late filing of IBR forms is a minimum of Rs. 10,000 and a maximum of Rs. 1,00,000.

How to fill out ibr forms?

To fill out the Income-Based Repayment (IBR) forms, follow these steps:

1. Gather required information: Collect necessary documents such as your latest tax return, recent pay stubs, and details of your outstanding student loans.

2. Obtain the IBR form: Visit the official Federal Student Aid website or contact your loan servicer to request the IBR form. You may also be able to find a downloadable version of the form online.

3. Personal information: Fill in your personal details accurately, including your name, Social Security number, contact information, and loan account number.

4. Family size: Indicate the number of people in your household, including yourself, your spouse, children, and any other dependents. This information is crucial to calculate your monthly payment amount.

5. Income details: Provide accurate information about your annual gross income. Include income from all sources, such as employment, self-employment, alimony, child support, or other benefits. If married and filing jointly, enter your spouse's income as well.

6. Adjusted Gross Income (AGI): If your latest tax return reflects a different AGI than your current income, you may need to use alternative documentation to verify your income. Follow the instructions provided in the form if this applies to you.

7. Repayment plan: Indicate that you are applying for the Income-Based Repayment plan and select your preferred payment plan term if options are provided.

8. Certification: Read the certification statement carefully, sign and date the form. Make sure to review all the information you entered before submitting your application.

9. Submit the form: Follow the submission instructions provided on the form. You may be able to submit the form electronically or by mail, depending on your loan servicer's guidelines.

Remember to keep a copy of the completed form for your records. If you have any doubts or questions during the process, don't hesitate to reach out to your loan servicer for assistance.

How can I get ibr application form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific ibr form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out navient ibr form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ibr forms. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out ibr request form on an Android device?

On Android, use the pdfFiller mobile app to finish your income based paye form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your ibr application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Navient Ibr Form is not the form you're looking for?Search for another form here.

Keywords relevant to s ibr form

Related to payment you icr

If you believe that this page should be taken down, please follow our DMCA take down process

here

.