DoE IBRPAYEICR Repayment Plan Request free printable template

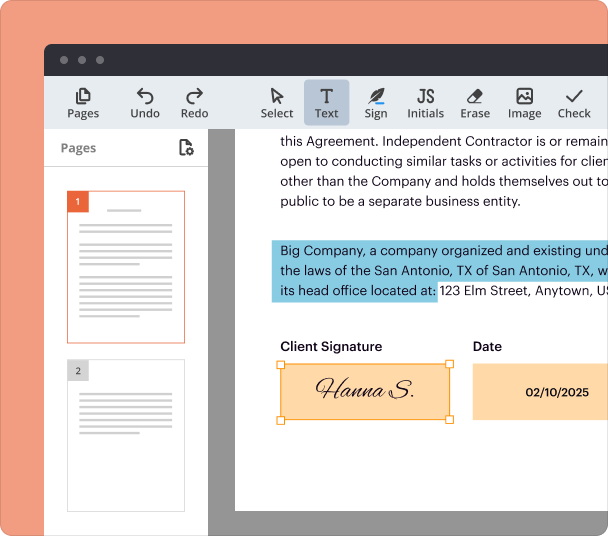

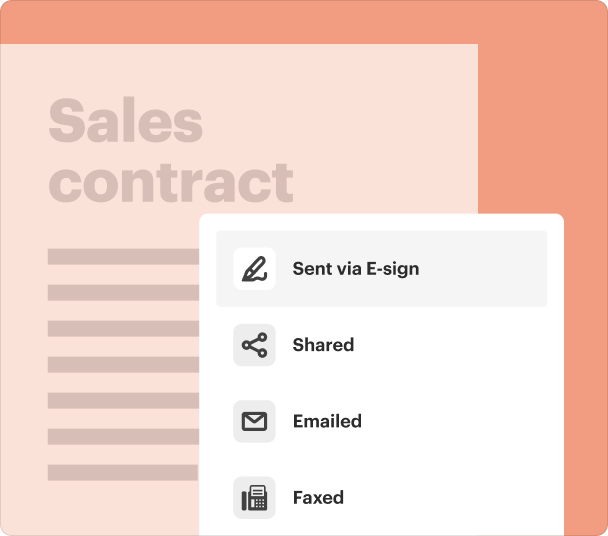

Fill out, sign, and share forms from a single PDF platform

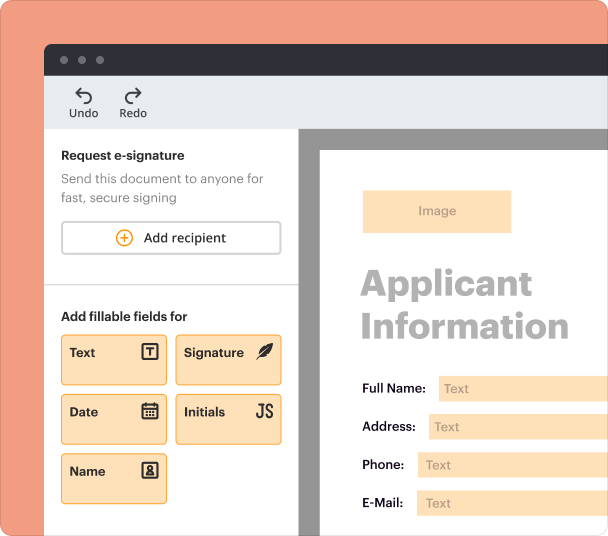

Edit and sign in one place

Create professional forms

Simplify data collection

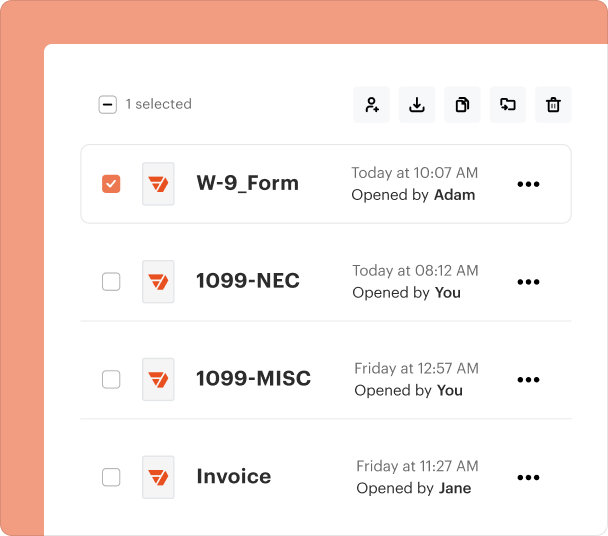

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

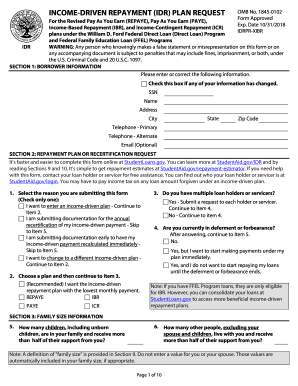

Comprehensive Guide to Filling Out the DOE IBRPAYEICR Repayment Plan Form

Navigating the world of student loan repayment can be overwhelming, especially when it comes to filling out the DOE IBRPAYEICR repayment plan form. This comprehensive guide will provide you with step-by-step instructions on how to successfully complete the form, ensuring you understand your options and the implications of your selection.

What are income-driven repayment plans?

Income-driven repayment plans are designed to make student loan payments more manageable by tying them to your income. The three primary types are Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Income-Contingent Repayment (ICR). These plans reduce monthly payments based on how much you earn, thereby providing relief to borrowers facing financial challenges.

-

IBR caps your monthly payments at a percentage of your discretionary income and can lead to loan forgiveness after a set period.

-

PAYE offers lower monthly payments compared to IBR, also leading to forgiveness after 20 years of qualifying payments.

-

ICR calculates your payments based on your income, family size, and loan amount, ensuring affordability as your financial situation changes.

Who is the IBRPAYEICR repayment plan form meant for?

The IBRPAYEICR repayment plan form is specifically targeted at borrowers who are experiencing financial distress and require tailored repayment options. To qualify, you must meet certain eligibility criteria, which typically include having a qualifying federal student loan and demonstrating financial hardship.

-

Borrowers who are struggling to make their monthly payments are ideal candidates for this form.

-

You must demonstrate a financial need to qualify and must have eligible federal loans.

-

Properly completing the form is crucial for adjusting repayments to reflect your current financial situation.

What does the IBRPAYEICR form comprise?

The IBRPAYEICR form is divided into several sections that require specific information. The first section requests borrower identification details, while the second focuses on the repayment plan request.

-

You must fill out personal information, including your Social Security Number (SSN), name, address, and contact details.

-

You need to select which repayment plan you wish to apply for and document your current income information.

How to complete your IBRPAYEICR form correctly?

Completing the IBRPAYEICR form accurately is essential. This section provides step-by-step instructions on filling out the form and highlights common mistakes that borrowers may encounter.

-

Follow the outlined steps to ensure every section is completed properly.

-

Be wary of frequently overlooked details, such as accuracy in your income documentation.

-

Double-check your entries against support documents to ensure compliance with federal requirements.

What considerations should you make before submission?

Prior to submitting the IBRPAYEICR form, it’s crucial to review important considerations such as accompanying documentation, submission methods, and any deadlines.

-

Check that you have the required documents, like recent tax returns and pay stubs, ready to submit.

-

You can submit your form electronically via studentloans.gov for convenience.

-

Be aware of submission deadlines, as they can significantly affect your repayment transition.

What are the implications of your repayment plan selection?

Selecting an income-driven repayment plan has long-term implications, including how your loan balance grows and any potential tax liabilities associated with forgiveness.

-

Understand how selecting an income-driven plan might increase the total amount repaid over time compared to standard plans.

-

Be aware that forgiven amounts under certain plans can be considered taxable income.

-

Explore other repayment options and compare their benefits to those of income-driven plans.

What steps to take after submission?

Once you have submitted your IBRPAYEICR form, there are several post-submission steps you should be prepared for to ensure you get the support needed.

-

Know what to expect regarding responses and processing times after submitting your form.

-

Keep track of your application status through the loan servicer’s website.

-

Utilize available resources for ongoing support concerning your repayment plan and financial management.

Frequently Asked Questions about income driven repayment form pdf

How long does it take to process the IBRPAYEICR form?

Typically, processing your IBRPAYEICR form can take anywhere from a few weeks to a couple of months. It's advisable to follow up with your loan servicer for status updates.

Can I switch repayment plans after applying?

Yes, you can switch between repayment plans as long as you meet the eligibility requirements. Just remember to resubmit necessary paperwork for your new plan.

What if I miss the submission deadline?

Missing the submission deadline may affect your eligibility for the income-driven repayment plan. It's crucial to contact your loan servicer to discuss possible next steps.

Are there any fees for submitting the IBRPAYEICR form?

There are typically no fees associated with submitting the IBRPAYEICR form. However, always check with your loan servicer for any specific conditions.

How often should I update my IBRPAYEICR form?

You should update your IBRPAYEICR form whenever there are significant changes in your income or family size that affect your repayment plan.

pdfFiller scores top ratings on review platforms